“Long-term changes still need

to be monitored and the issue

of vaccines or other defenses is

not yet clear.”

In the second quarter of 2020, the office building market was faced with problems due to work from home policy in order to prevent the spread of COVID-19. Although many companies have come to realization the lesser need of a physical office, but this has no effect on business operations or leasing agreement of office space. However, the second round of covid-19 spread in mid-December 2020 until early 2021 would have a serious effect in downsizing some companies and reduction of office rental space. But long-term changes still need to be monitored as the ongoing spread of the COVID-19 virus and the issue of vaccines or other defenses is not yet clear.

Supply

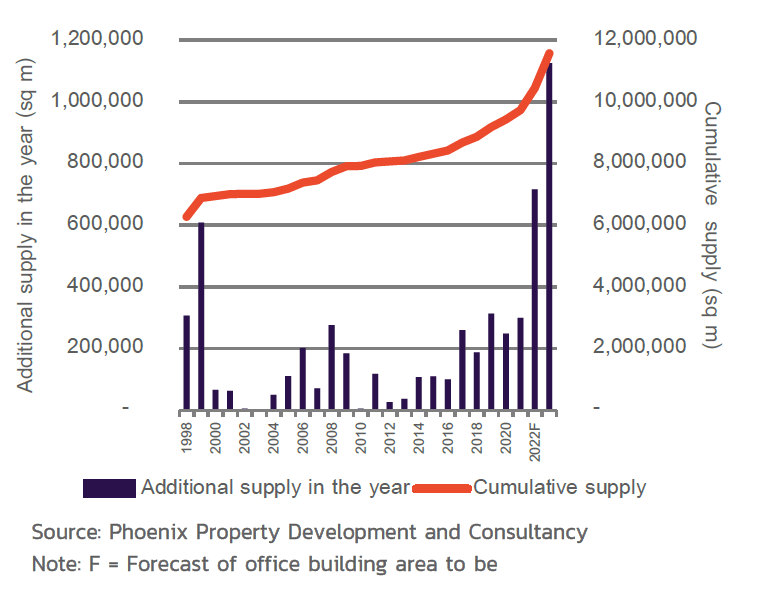

New Office Space in Each Year and Total. Area in Bangkok by Year.

Total office space in Bangkok at the end of 2020 is approximately 9.4 million square meters. Since 2017, more than 150,000 square meters of new office buildings have entered the market per year, which is targeted to continue through 2023. In the year 2022, there will be more than 700,000 square meters of new office spaces launched in the market and more than 1 million square meters in 2023. There may be changes in the size of the area and the schedule for the completion of the construction as the buildings to be completed in 2022 – 2023 are all under construction.

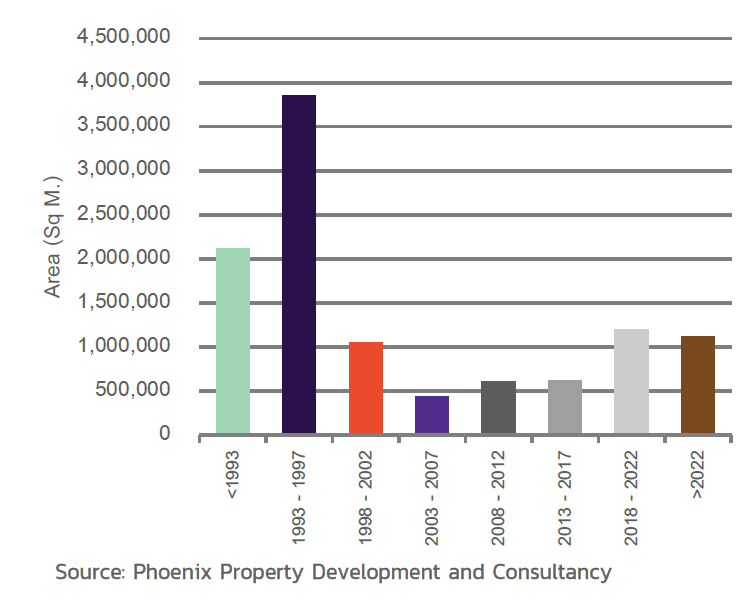

New Office Supply in Every 5 Years.

The period between 1993 and 1997 was the time when the office market in Bangkok experienced the greatest expansion in terms of supply and rental rates. Because there were many buildings in the period prior to the year 1997 with a rental rate of more than 500 – 600 baht per square meter per month. However, after 1997, construction of many office buildings stopped. New office buildings have continued to decline in supply and the rents are lowered from the over-supply. After the year 1997, the office space has increased in a smaller proportion compared to the increase in the period 1993 to 1997.

There had been a lot of office building spaces that have entered the market over the years. Although not as many as in the past, but it has begun to concern the owners of the old building with lesser tenants. Since the new office building is in the same location as the old building, it is likely that some tenants will move away from the old building as they need a larger office space. Even though the rent is higher, this is because the previously leased building cannot expand the leased space or need to rent more than 1 floor. In addition to COVID-19 having an impact on the income or operating results of the business, it also directly affects the working style of many companies because work at home policy. Even the work from home policy lasted for a short period of time, but this may have impact in company restructuring as they have come to realization that some departments are not needed, or some departments should be outsourced. This may result in many companies’ rental space reduction or the expansion plan in the future. It may also affect office buildings that are going to be completed in 2021 onwards.

Demand

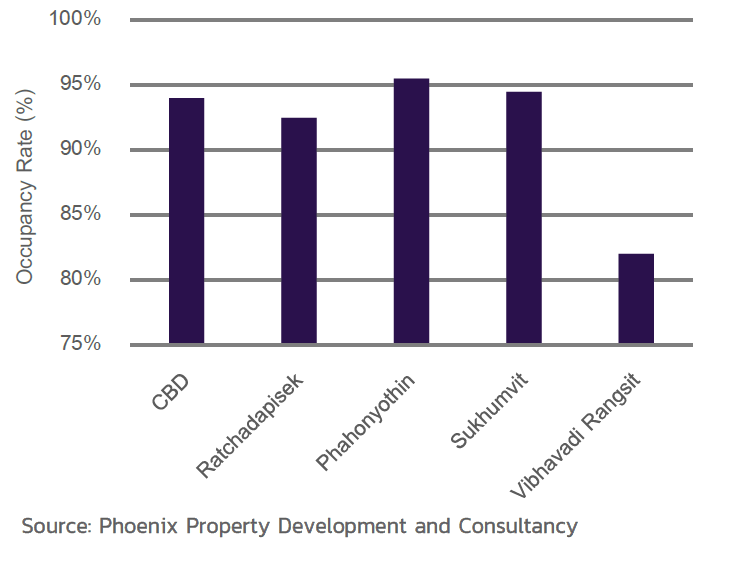

Average Occupancy Rate in The Important Zones of Bangkok.

The slowdown in the world economy and Thai economy, including the problem of the COVID-19 virus, has begun to affect business expansion or overseas business operations since the second half of 2019. The average occupancy rate for office building in Bangkok as of Q4 2020

was approximately 91.15%, a slight decrease from the beginning of the year. Although in some locations, more space has been rented from the new office buildings that opened in the past 6 months. However, the proportion is small compared to the average rental rate of Bangkok. One of the reasons is because tenants have delayed office relocations plan from the pandemic effect.

Moreover, new office buildings entered the market, thus affecting the average rental rate.Office market overview in 2020 is rather slow, because surveillance of the COVID-19 epidemic has resulted in a change in lifestyles and work styles of the entire world. This has resulted in some companies having to reconsider their own office space plans. The economic slowdown that hit all over the world and the COVID-19 pandemic have resulted in low income or almost no income for many companies.

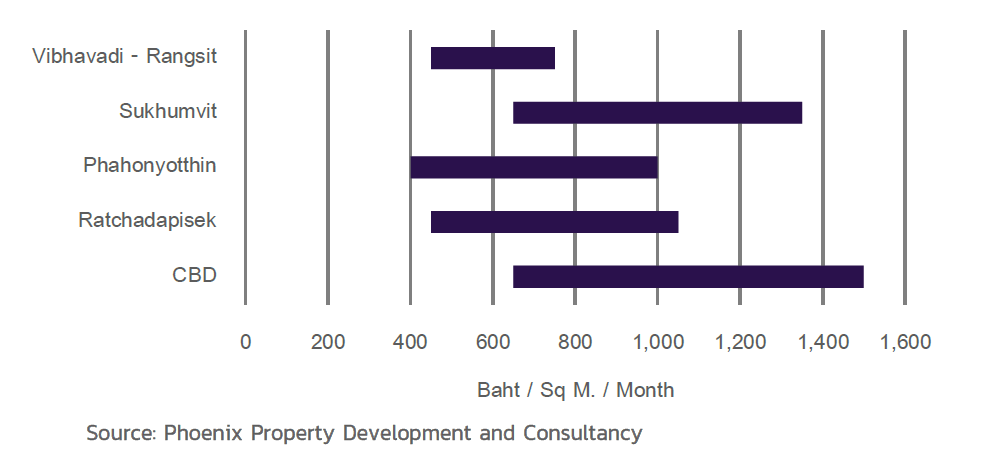

Rental Rates

Average Rental Rates in The I mportant Zones of Bangkok.

Office space rental in the fourth quarter of 2020 has not clearly decreased. While negotiations for a price reduction or rent negotiations are already evident in some buildings, this is not a big reduction overall or it may come in the form of keeping the rent at the same level and able to extend the lease further. There were some building owners who have reduced their rent during the second to third quarter of 2020.

Average Grade A office rent in the CBD area is around 1,100 baht per square meter per month, while the same grade office buildings outside the CBD are around 800 – 850 baht per square meter per month. It shows that Grade A office buildings in the CBD area can clearly call for higher rents. But it has still failed to attract or push landowners in the CBD to develop office buildings because the rental income does not justify the land price.

The rent of Grade A office buildings in the CBD area which were completed in the past 1-2 years is more than 1,200 baht per square meter per month, some buildings are at more than 1,400 – 1,500 baht per square meter per month. Most of the office buildings that are under construction and scheduled for completion in the next 2 – 3 years are mostly grade A office buildings as well. Therefore, the rent for office space in the future is likely to be quite higher when comparing office buildings of the same grade in the same location. However, the economic conditions and future supply will come to play in a role too.

Summary of market overview and future trends

The office building market must keep an eye on for many years.

Office spaces that will enter the market in the next 3 – 4 years is a lot.

The demand for office space is highly variable and involves many factors.

Rental rate of office space in 2021 would not be different from the year 2020.

Covid-19 crisis it may affect the office market in the long run if it is not able to return to normal life soon.

The changing working styles are likely to affect the office building market in the future.