In addition to factors of the spread of the COVID-19 virus. In the past year and year 2021, there are still issues of unsold units that have put pressure on all developers in order to manage cashflows.

2020 is the time when all developers choose to reduce the launch of new condominium projects since they had a huge available units left for sale in the market and unfavourable market condition. There were some new condominium projects launched throughout the year 2020 and the first quarter of 2021, but the number of units is very small when compared with the same period of the past 2-3 years.

Supply

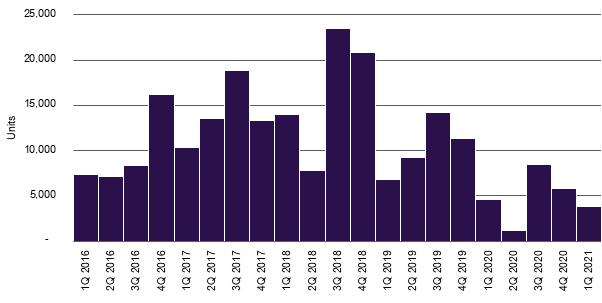

New condominium launches by quarter in Bangkok as of 1Q 2021

Source: Phoenix Property Development and Consultancy

New condominium launches in 1Q 2021 totalled approximately 3,840 units, a 33% decrease from 4Q 2020 and a 17% decrease from 1Q 2020. The first quarter of 2020 is still a time when the epidemic in Thailand is not severe and has not yet been locked down at all. More than 1,000 people in Thailand. But the situation in the first quarter of 2021 was not like that. Because of the number of new infections has continued to ripple since the end of 2020. After the third consecutive quarter, the fourth quarter of 2020, the situation seems to improve.

Given that the situation seems to have continued to be monitored since the end of 2020, confidence and the confidence in the spending of money of Thais has decreased as well. The condominium market has been inevitably affected, developers chose to delay the launch of new projects in Q1 2021, the number of new condominium units launched in 1Q 2021 compared to the first quarter of many years was low. New condominium units launch in the year 2021 there is a possibility that will differ slightly from 2020 depending on the situation in the second half of 2021.

Another important factor that affects home and condominium sale is the subject of applying for a bank loan as the amount of rejection rate continues to increase throughout 2020 to beginning of 2021. Especially in residential projects with the price level below 3 million baht, credit rejection amount as high as 30-40% on average. Because buyers still do not understand the subject of applying for a bank loan and still have other liabilities pending. But the matter that developers come out to demand the most is more stringent the scrutiny of bank loans regulation.

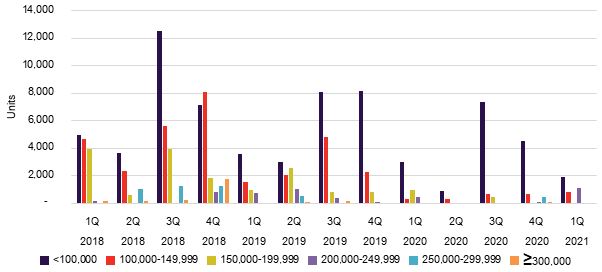

New Condominium Units Launches in Bangkok by Price Range As of 1Q 2021.

Source: Phoenix Property Development and Consultancy

Condominiums at the price level below 100,000 baht per square meter are the selling price levels that developers are interested in and are also the selling price levels that reach the largest purchasing power in Thailand. In addition, the extension of many mass transit lines from the inner city area. This is a direct positive factor allowing developers to purchase land in distant locations to develop condominium projects at the price of less than 100,000 baht per square meter continuously.

During a period of stable economic growth although at a small level. Condominium developers are also launching new projects in all price ranges, but more focusing on condominium projects that have a selling price of less than 100,000 baht per square meter. The proportion of the project at other selling price levels is descending according to the proportion of purchasing power. Developers will significantly reduce their project proportion to other selling prices, except some developers who are relatively confident in their own buyers may still have more expensive projects launch for sale in the past several quarters.

Demand

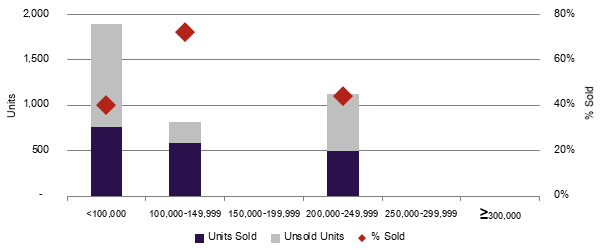

Average Take-Up Rate of New Condominiums Launched in 1Q 2021

Source: Phoenix Property Development and Consultancy

The average take-up rate of new condominiums launched in the first quarter of 2021 is approximately 48%. But it reflects the economic condition and the confidence of purchasing power as well that it is still in a slowdown. Although there is a higher take-up rate compared to the previous quarter and there are many condominium projects that are attracting attention that they have very high sales rates or they have almost sold out, but it does not mean that purchasing power has recovered. This is because a group of buyers may be interested in certain projects of certain developers who are selling new projects only and did not pay attention to all new projects launched.

New condominium projects launched in the area along the mass transit lines continue to attract attention, perhaps due to the project concept and the publicity of developers. In addition, there are some projects that have started selling since the end of 2020, even though they have opened a sales office since Q4, 2020 and are now open for reservations, but they are open for online booking or open bookings for some VIP buyer groups only. When it officially launched for sale in the first quarter of 2021, it had a relatively high take-up rate and immediately attracted more attention from buyers.

Price

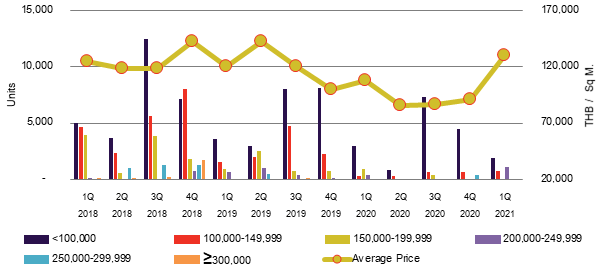

New Condominiums Launched By Selling Price and Average Prices By Quarter

Source: Phoenix Property Development and Consultancy

New condominiums launched in the first quarter of 2021 are approximately 49% in the price range not exceeding 100,000 baht per square meter. But interestingly, there are condominium projects in the price range of 200,000 – 249,999 baht per square meter up to 29% of new condominiums launched in Q1 2021. As a result, the average selling price of the newly launched condominium units is approximately 130,000 baht per square meter. It is the highest average selling price level in the past several quarters, although there were some condominium projects with a selling price of less than 100,000 baht per square meter launched in the first quarter of 2021.

Developers still pay attention to locations that can see their potential at present, both in locations where mass transit lines are already operated and in locations along the mass transit lines that are under construction. Especially in a location that is a residential community, there are already various amenities, maybe just waiting for the mass transit station to operation in the next few years.

Summary of market overview and future trends

Condominium Market in 2021 is still on a slowdown from 2020.

New condominium for sale in the year 2021 it is possible to be in the range of 20,000 – 25,000 units.

Condominium market situation in 2021 based on the second half of 2021.

Developers continue to focus on ready to move in projects and transferring the ownership of condominium units rather than launching new condominium projects continuously from 2020.

The disappearance of foreign buyers has definitely affected some developers who are focused on foreign buyers, especially those that are ready to transfer ownership in 2021.

Foreign developers and investors are still interested in seeking joint venture with Thai developers.

Many Thai developers are open to joint ventures with Thai or foreign investors in order to reduce their own investments.

Small and medium-sized developers may need to halt project development to reduce costs during this period.

Many condominium projects may be required to postpone the construction deadline due to labor shortage.