The condominium market in Thailand has slowed down due to the economic slowdown, because of the impact of the COVID-19 epidemic which has continued since the year 2020. Developers have launched more new condominium projects in 2021, compared to the previous year.

Just a condominium project that was launched for sale during this year, it is a project in the price range of not more than 4 million baht per unit. Many projects have a starting price of fewer than 2 million baht per unit. or having a selling price in the range of 25,000 – 50,000 baht per square meter. Most developers still focus on selling housing projects and reduce to launch new condominium projects, which is in the same direction as the previous year.

Supply

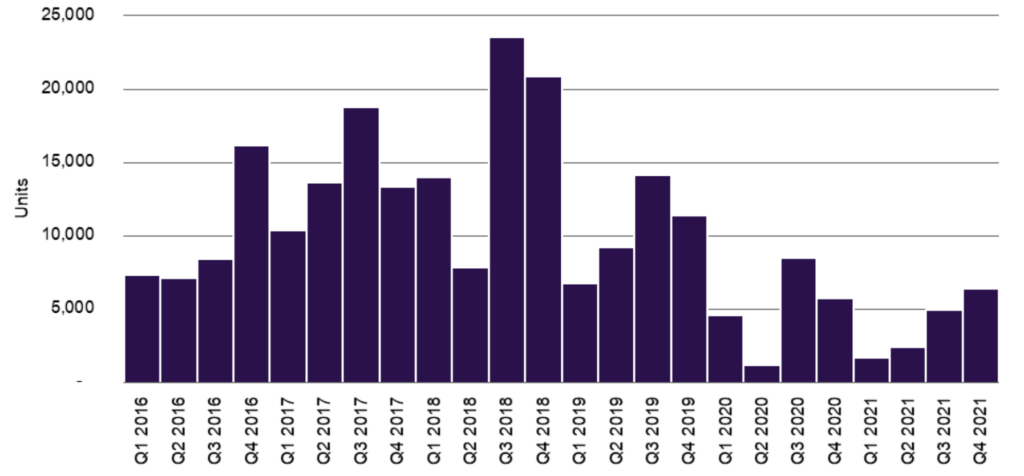

New condominium launches by quarter in Bangkok as of Q4 2021

New condominium units were launched in Q4 2021 with a total of approximately 6,400 units, an increase of approximately 30% from Q3, although more than the first and second quarter of this year, but still below the same period of past many years. There are approximately 15,480 units in total and approximately 8% more than the total number in 2020. But most condominium projects in 2021 were launched in the second half of the year, which is in the same direction as the previous year.

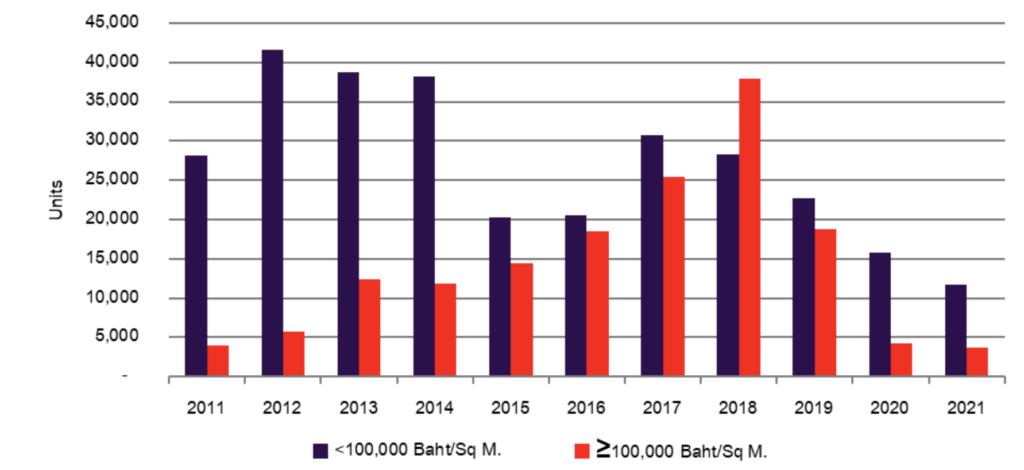

New Condominium Units Launches in Bangkok by Price Range

Condominiums in the price range below 100,000 baht per square meter or not exceeding 3.5 million baht per unit are the selling price levels that many developers are interested in. It is also the selling price level with the largest group of buyers in Bangkok. The condominium projects at this price level are the group that developers launched the most and continued for a long time. This can be seen from the year 2011, since then condominiums priced below 100,000 baht per square meter are clearly more than condominiums at higher prices. Just only 2018 that developers increase to launched a new condominium project at a price of more than 100,000 baht per square meter. Because there are projects in the price range of 100,000 – 150,000 baht per square meter that are open for sale more than projects in other price ranges.

When the economy is likely to be positive or has a high growth rate, developers will increase the proportion of more high selling prices of condominium projects to be in line with increasing purchasing power. But when the economy is in a direction of decline or most people lack confidence in spending. Developers will increase the proportion of projects with a selling price of fewer than 100,000 baht per square meter. The Bank of Thailand’s temporary relaxation of mortgage and other loans related to mortgage loans (LTV measure). But this may not result in the housing market becoming more active as intended. It only stimulates purchasing power for certain groups of buyers who are ready to apply for bank loans and must have an additional second residence

Demand

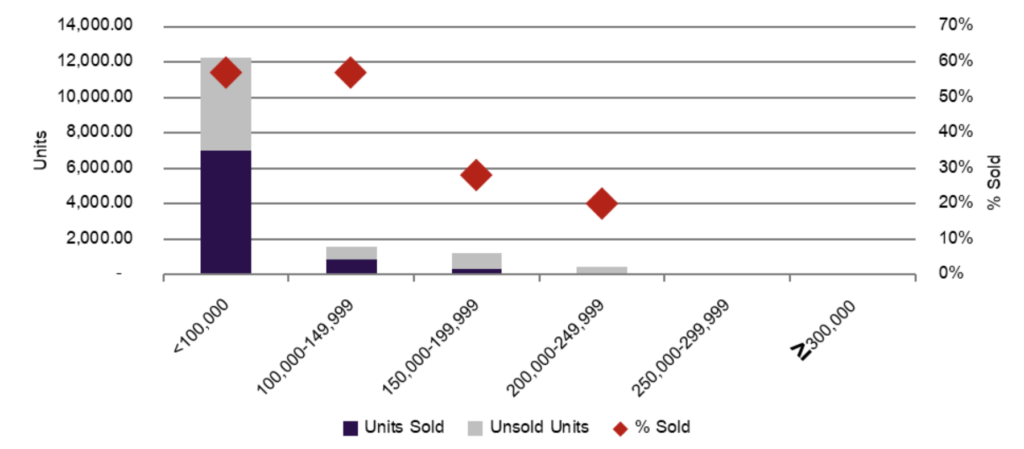

Average Take-Up Rate of New Condominiums Launched in Q4 2021

The average take-up rate of newly launched condominium units in 2021 at about 54%, may not look very much. But it reflects the economic situation, purchasing power confidence is very strong that it is in a clear recession. Although the average take-up rate is higher compared to 2020 and there are still many projects that have a high take-up rate or can sell out shortly after the official launch. Many condominium projects that have a selling price of not more than 70,000 baht per square meter and it is a project that is in a good location not far from the mass transit stations that are already in service or under construction and is scheduled to open in 2022 were got the high take-up rate.

Many developers are more focusing on condominium projects in the price range below 80,000 baht per square meter. Some developers are focused on condominiums with low prices or about 1 million baht per unit at all. Because they are want to access a large group of purchasing power. Even if there is a risk of failing to apply for a bank loan, because of the problem of household debt. But developers who are interested in this group of customers try to make them understand from the beginning in terms of applying for bank loans. To prevent or reduce the problem of not applying for bank loans and cannot transfer ownership. The matter of bank loans has become an important factor in the housing market than the matter of launching new projects or measures supported by the government sector.

Price

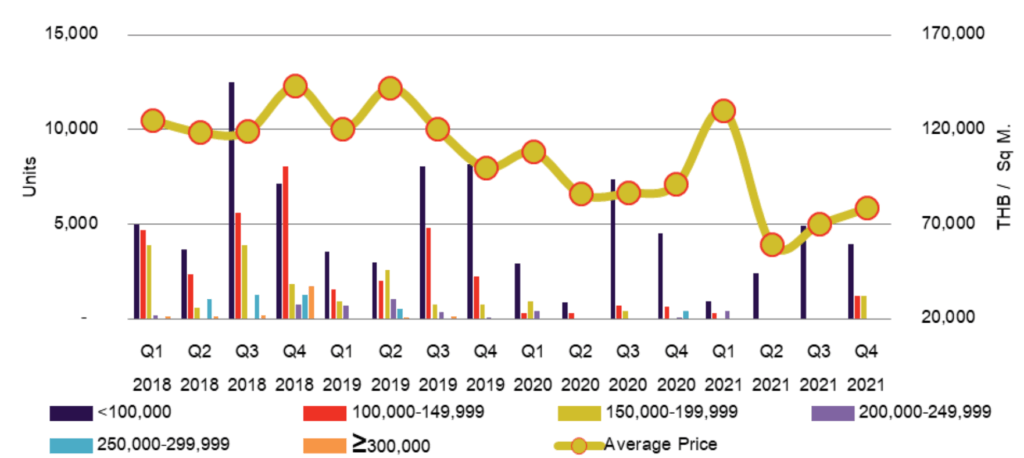

New Condominiums Launched By Selling Price And Average Prices By Quarter

About 76% of new condominiums launched in 2021 are in the price range of not more than 100,000 baht per square meter. As a result, the average selling price of newly launched condominiums is approximately 90,000 baht per square meter. It is a relatively low average selling price level, compared to the rise in land prices in Bangkok, which was influenced by the development of various mass transit routes. Although there are some condominium projects with selling prices of more than 200,000 baht per square meter. But it accounted for a very small percentage or only about 3%, so it did not affect the average selling price of new condominium projects launched in 2021.

More developers decided to launch new condominium projects in areas along the mass transit lines that are already in operation than other areas. Because they want buyers to see the potential and be confident in the potential of the location at present, do not have to wait or not have to predict how much more potential in the next 1-2 years this location. or when the mass transit routes have been operated. The area along the mass transit lines that are under construction for every line is another location that has received interest from developers.

Popular locations in 2021, in addition to being located in the line of mass transit lines that are under construction, are also a potential location with a community or is a location where the potential can be seen from the present. May be waiting for the construction of the mass transit stations only, but other facilities it has been supported previously.

Summary of market overview and future trends

Condominium market in 2021 is in the most severe slowdown in the past 10 years.

The condominium market will not recover in 2022, which must continue to look at the situation from the beginning of the year as well.

The second half of 2022 there is a possibility that the condominium market will recover or there will be more new projects launch.

Developers are more focusing on housing projects than condominium projects

Lower price condominium projects will continue to be increased in the market that many developers will continue to pay attention to in 2022.

The disappearance of foreign buyers affects some developers who are definitely focused on foreign buyers.

Developers and foreign investors or developers are still interested in looking for joint venture partners to invest in real estate projects in Thailand.

Many Thai developers are open to joint ventures both from abroad and in Thailand to reduce their own investment.