“The condominium market in Thailand has clearly slowed down due to the economic slowdown and the effects of the epidemic of the Covid-19 virus”

which has a direct effect on the changing lifestyles and work. Closing retail projects or temporary and permanent closure of many companies has a direct effect on the purchasing power of Thais whose confidence has decreased and choose to spend less. Buying residences at the moment is not the right time. But for those who are ready, it turns out to be the most suitable time because it can get a residence, whether it is a house or condominium at a low price, as well as additional free gifts or special discounts. But for general people, it is more difficult to request for loans, especially those working in businesses that are clearly affected, including aviation, airport, hotel, tourism, food and drink, automotive industry, and other industries related to foreign countries where orders or production volume decreased to a temporary and permanent closure. Residential project around the airport and many industrial estates have been affected in the second quarter.

Supply

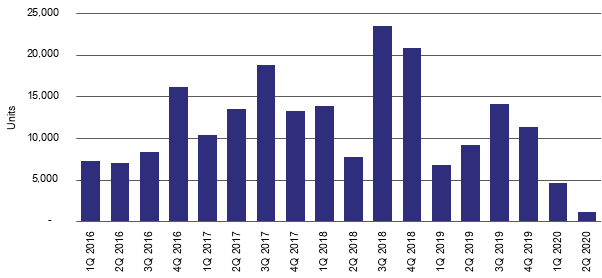

Newly Launched Condominium Units in Bangkok by Quarter as of 2Q 2020

New condominiums launched in the second quarter of 2020 were approximately 1,200 units, 74% decreased from the first quarter. This is the lowest newly launched condominium units per quarter from the past 10 years. There are only 5,800 new condominiums released during the first 6 months of this year and it is still the lowest in more than 10 years.

Most developers choose to postpone the launch of condominium projects during the year 2020. But there are still some developers that are still moving forward as planned. However, they only choose to open some condominium projects only in potential locations and the selling price is not very high in accordance with purchasing power in this market condition. Developers who have previously purchased land and have the possibility of not being able to develop the project during this 1-2 years period will immediately announce to sale some plots of land. Many developers are not buying land to develop new condominium projects in 2020. If bought, it may be in the term of joint development with the land owner or not paying cash to the land owner.

The overall condominium market in the second half of this year is not much different from the first half of this year because of the negative factors from the first half. Some factors are likely to be more severed such as political and tourist conditions. Foreigners’ traveling to Thailand remains unclear, although foreigners may be allowed to enter certain groups, the number may not return to normal as before. If Thai tourism business has not returned yet, it would be difficult for the economy to return and the confidence of Thai people will still be in the slowdown period. All developers probably choose to close the sale of all completed project, reduce the opening of new condominium projects, and increase the proportion of housing projects like the first 6 months of this year. Total new condominiums units launch in this year are probably around 20,000 -25,000 units, lower than expected at the end of last year before the outbreak of the covid-19 virus. However, the situation in the second half of the year will play a role too.

Many listed developers are still trying to find funding for project development through other channels that rely less on banks. For example, through issuance of debentures (short-term, long-term, and unlimited duration). Although these debentures may offer higher yields than bank interest rate, but they choose to raise funds like this for the speed in the development of new projects. Another option is finding partners to develop projects so they do not need to use 100% of the company’s capital. This method can be done only for big or medium developers in the stock market only. Small or medium-sized companies outside the stock market may have to try to keep their positions alive during this severe economic downturn and is expected to take more than 1-2 years to see recovery.

Demand

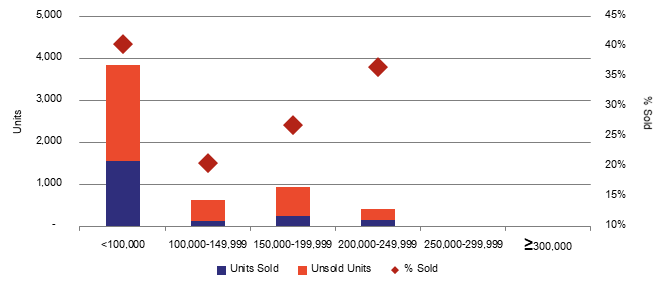

Average Take-Up Rate of Newly Launched Condominium Units As of 1H 2020

The average sales rate of new condominiums sold during the first 6 months of this year is only 36%, indicating the economic condition and cconfidence in the purchasing power is clearly in a recession. The reduction of new condominium projects launched in the first 6 months of the year is a clear expression for the developers that they are less interested in condominium projects, but increasing the proportion of housing projects. Reasonability Index for Buying a New Residences, According to the Survey by Center for Economic and Business Forecasting of The University of the Thai Chamber of Commerce as of June 2020 is approximately 26.8 increased by around 19% from April but still the lowest in more than 10 years, reflecting in confidence of the long-term economic conditions and the situation of the spread of the Covid-19 virus.

The condominium market has previously been affected by various negative factors, but the most severe of these is the Covid-19 virus. New condominium projects launched in the second quarter of 2020 have an average take-up rate of only 30%, the lowest in 10 years as well. This reflects the lack of confidence in Thai economy in long run. Even though some condominium projects sold out after the developers have reduced the prices or offered the promotions during the past 2-3 months, it is only a small percentage compared to the remaining condominiums waiting for absorb in the market with approximately 57,000 units.

Selling Price

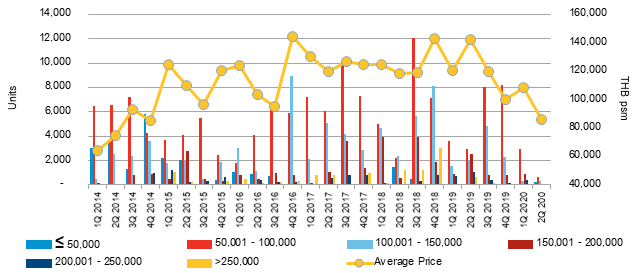

Newly Launched Condominium Units in Bangkok by Quarter and Average Selling Price

New condominiums launched during the first 6 months of this year are in the price range of not more than 100,000 baht per square meter, which is the price of up to approximately 77% of total new condominiums launched during the first 6 months of this year. Developers were choose to sell affordable condominium projects during the economic downturn to be consistent with the purchasing power in Thailand. The location that developers have chosen to launched condominium projects in the past is the location that can see the current potential, no need to wait another 1-2 years. There may be some that have to wait for the construction of the sky train and subway lines. In addition, many projects are not on the main road or near the sky train or subway stations, because the developers want to launch condominium projects that can sale with affordable price.

The average selling price of newly launched condominiums in the second quarter of 2020 is approximately 86,000 baht per square meter, a 14% decrease from the last quarter and is the lowest average selling price of newly launched condominiums in the past many years.

Summary of market overview and future trends.

Condominium market is still in the worst slowdown in over 10 years.

The condominium market will not recover in the second half of 2020.

Many developers were focus on completed projects with ownership transfer and housing projects rather than launching new condominium projects

New condominium launched in 2020, it is possible to be in the range of 20,000 – 25,000 units and depends on the situation in the second half of the year as well.

Some developers were chosen to sell land that has plans to develop into condominium projects.

Disappearing of foreign buyers have an impact on certain developers that focus on foreign buyers, especially projects that scheduled to be transferred in 2020.

Developers and foreign investors are still interested to find a joint venture partner to invest in real estate projects in Thailand.

Many Thai developers are open to joint ventures from abroad and in Thailand to reduce their own investment.

Small and medium-sized developers may need to stop developing new projects to reduce costs during this period.

Some big developers have reduced the price of condominium sales by ignoring previous buyers.