The outbreak of the covid – 19 in the first half of 2020 had affected the routine life of people in Bangkok and in every Provinces all over Thailand.

As traveling to a working place can be a risk, many companies choose to let their employees work at home to avoid traveling and to reduce the spread of the virus in accordance with government policy. Many office buildings are inevitably affected. Many companies bargain with office owners to reduce the rental fee. The negotiation to reduce the rental fee is between 20 – 50% in the period from 2 – 6 months, depending on the agreement of the tenant and the owner of the building.

Supply

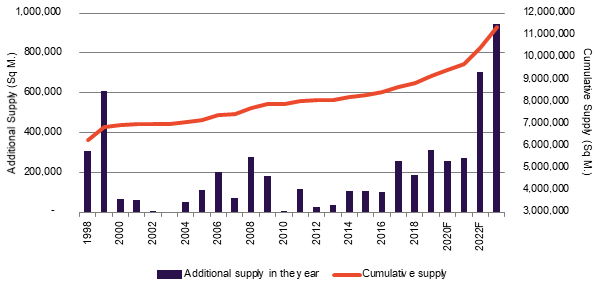

New office space in each year and total area in Bangkok annually

Note: F = Forecast of office building area to be completed that year

New office building opened in the first half of 2020 accounted for approximately 171,400 square meters, most of which are located in the outside CBD area, Sukhumvit Road, Rama 4, Rama 6, Narathiwat Ratchanakharin, and etc. Some new office buildings are occupied by the owners of the buildings. The total area of office buildings in Bangkok as of the second quarter of 2020 is approximately 9.34 million square meters which is the total area of all office buildings in Bangkok.

Bangkok will still have about 84,300 square meters of office buildings open during the last 6 months of 2020 and approximately 2 million square meters that are currently under construction and scheduled for completion within 3-4 years from now on. The outbreak of the Covid-19 virus has major impact in the confidence of entrepreneurs and developers of office building projects. Because working at home has become a more feasible option and some companies have layoff policy, some companies are likely to reduce in size.

Many office buildings in the CBD area are currently being constructed on the long-term lease land, which is a lease from the government agencies, The Crown Property Bureau, and private agencies. In addition, many office buildings are a joint venture between landowners and developers.

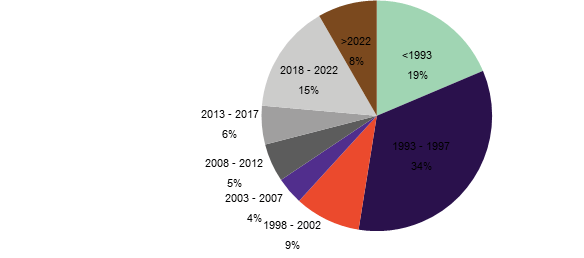

New Office Supply every 5 Years

The total office area and the office scheduled for completion in 2023 in Bangkok are approximately 11.36 million square meters. In a period of 5 years from 2018, there have been offices open for new services continuously.

New office buildings are increased by approximately 1.73 million square meters. This resulted in approximately 15% increase annually from 2018 to 2022, the highest figure since the period before 1997. The rise of office buildings in the last 5 years reflects that office buildings are a form of real estate projects that can generate a reasonable income for developers and landowners. Although the income may not be as fast as condominium projects, but it can generate longer-term continuous income. In addition, office buildings are real estate projects that can be sold into REITs, which is an attractive alternative for current office building owners.

Demand

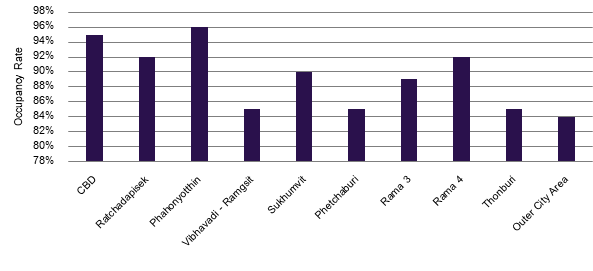

Average Occupancy Rate by Zone

The global and Thailand economic slowdown and the covid-19 pandemic have a major impact on business expansion or business operations internationally since the second half of the year 2019. The average occupancy rate of overall office space in Bangkok as of the second quarter of 2020 is approximately 92.6%, not much different from the previous quarter. In some areas, average occupancy rate increased from new office buildings that have opened in the past 6 months, but only a small increase considering the average occupancy rate of overall Bangkok area. Some tenants delayed the plan to move their offices than expected.

The office market in the first half of 2020 was very quiet because the covid-19 prevention regulation has changed the way of life and work styles.

Although the regulation lasted only 1 – 2 months, some companies had reconsidered their own office space plans. although many things began to return to normal in mid-May, but the economic slowdown and Covid-19 pandemic has resulted in many companies having lower incomes or almost no income.

Most businesses still have not recovered yet, while some businesses have decreased revenue or may not have any income at all until when the possibility of vaccines is clearer. There may be employees layoffs or more employees working at home. Renting office space may become unnecessary, building owners may face the problem of having more office space vacancy. However, it is not possible to request to cancel or reduce the rent space immediately because the lease contract of office space lasts 3 years on average. In addition, the owner of the office building would not agree, because they were also in trouble too. Except for a group of tenants whose contracts are almost expired, which may review the renewal of the lease or delay the move to other office buildings.

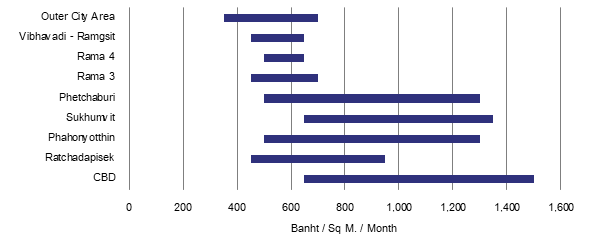

Rental Rates

Average Rental Rates by Zone

Average rental rate of overall office space rental in the second quarter of 2020 has not decreased significantly. Although negotiations for price reductions or rents negotiations have been seen in some buildings or may come in the form of maintaining the rents at the same level while able to extend the lease further.

Average Grade A office space rents in the CBD area are around 1,100 baht per square meter per month, and a 5% increase from the same quarter last year. While the same grade office buildings outside the CBD area are around 800 – 850 baht per square meter per month. Grade A office buildings in the CBD area can clearly ask for higher rents. However, the higher rate can attract or push landowners in the CBD to develop office buildings, because the rental income received is not suitable for the land price.

Rental rates of Grade A office buildings in the CBD area that have been completed in the past 1-2 years are over 1,200 baht per square meter per month. Most office buildings that are currently under construction and scheduled to be completed in the next 2 – 3 years are Grade A office buildings as well. Therefore, future rents are likely to be much higher than the present rate, when comparing the same grade buildings in the same location.

Market overview and forecasts for the future

The office market must keep an eye on for many years.

There are a lot of office buildings that are about to enter the market in the next 3 – 4 years.

The demand for office space is extremely variable and involves many factors.

Office rental fees in Bangkok in 2020 Probably not much different from previous years.

The lessee negotiated to reduce the office space rental fee from the original rate but the owner of the building probably did not reduce as requested.

The Covid-19 Crisis it may affect the office market in the long run if it is not able to return to normal life quickly