“The development of EEC

is a catalyst for the development of

new industrial estates”

The development of Eastern Economic Corridor (EEC) is a catalyst for the development of new industrial estates, especially the industrial estates that are developed by private sectors. Including those that are awaiting development, Chonburi and Rayong Province is the area that has the most emerging industrial estates with approximately tens thousands of Rai.

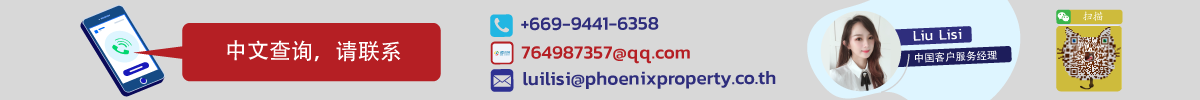

Supply

Industrial Estate in Thailand as of End of 2019

Total area of industrial estates that are operated at the end of 2019 with a total of approximately 183,200 rai, including all industrial estates and industrial parks throughout the country, industrial estates which are developed by Industrial Estate Authority of Thailand (IEAT), industrial estates that are jointly developed by IEAT, and industrial estates that are developed by the private sectors. Future industrial estate areas in Thailand tend to increase significantly from the EEC development.

Industrial estates in Thailand tend to skyrocket after the announcement of EEC’s Town Planning, which covers Chachoengsao, Chonburi, and Rayong provinces. The EEC’s Town planning raise the recognition of the area in and out of the industrial zone. Chachoengsao is the province that is most affected since it is outside the permitted areas according to the town planning.

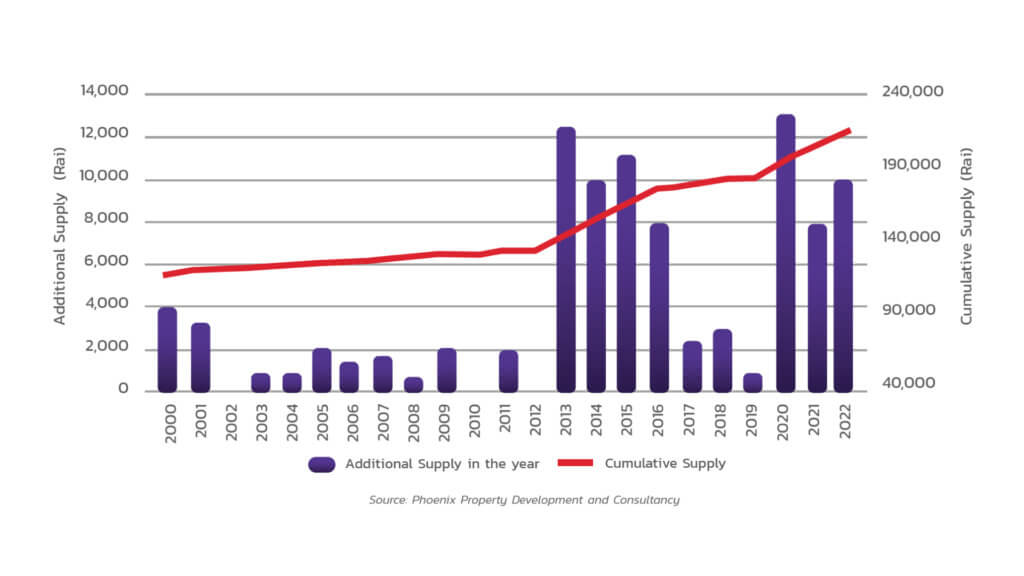

Total Industrial Estates area in Thailand by Region as of End of 2019

Approximately 57% of industrial estate areas are in the eastern region. From 2019 onwards, most industrial estates that are in pipeline will be in the eastern region to be in line with government investment promotion. However, there may be limitations for industrial estate expansion from the new town planning and objections from people in the area which may affect many industrial estates that have already been in development for many years and have sold out the area. In addition, the higher land price makes it more difficult for developers to buy land in the new EEC industrial area.

In the eastern region, there are many existing developers such as CPGC (a joint venture company between CP Land Company Limited and a company from China), WHA Industrial Development Public Company Limited, Pinthong Industrial Park Public Company Limited, Rojana Industrial Park Public Company Limited, and Amata Corporation Public Company Limited. In addition, there will be many new industrial estates as well as new developers.

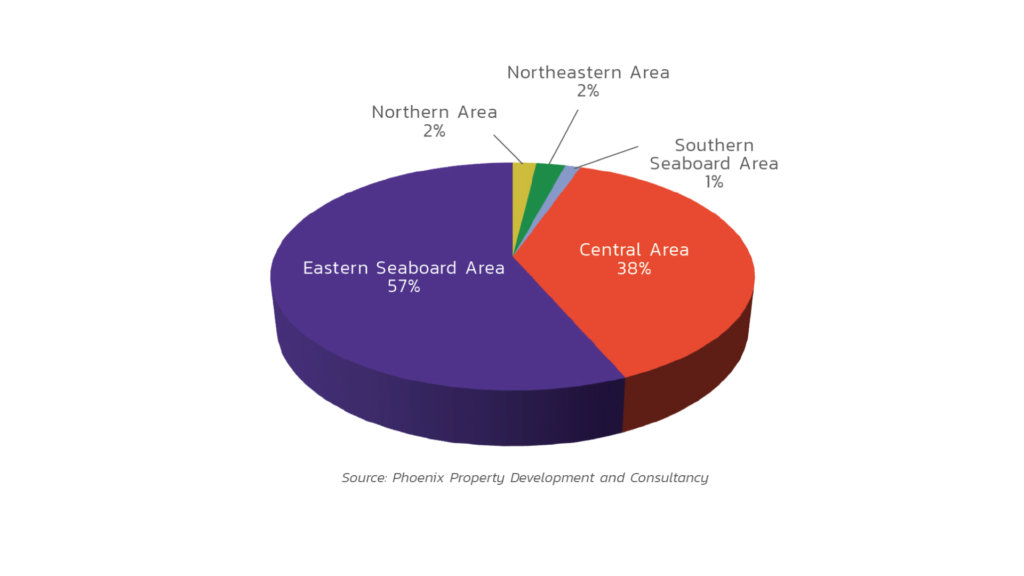

Demand

Total Occupancy Rate of Industrial Estates in Thailand by Region as of End of 2019

The average occupancy rate of overall existing industrial estate in Thailand is 89%. The two biggest contributing regions are the eastern and the central region. The eastern seaboard area has the highest occupancy rate, followed by the central area. There were no new industrial estate for many years in the central area from the higher land price and the flooding scheme in 2011 that had created a long-term effect on investment. The other areas do not have much effect on the industrial estate market.

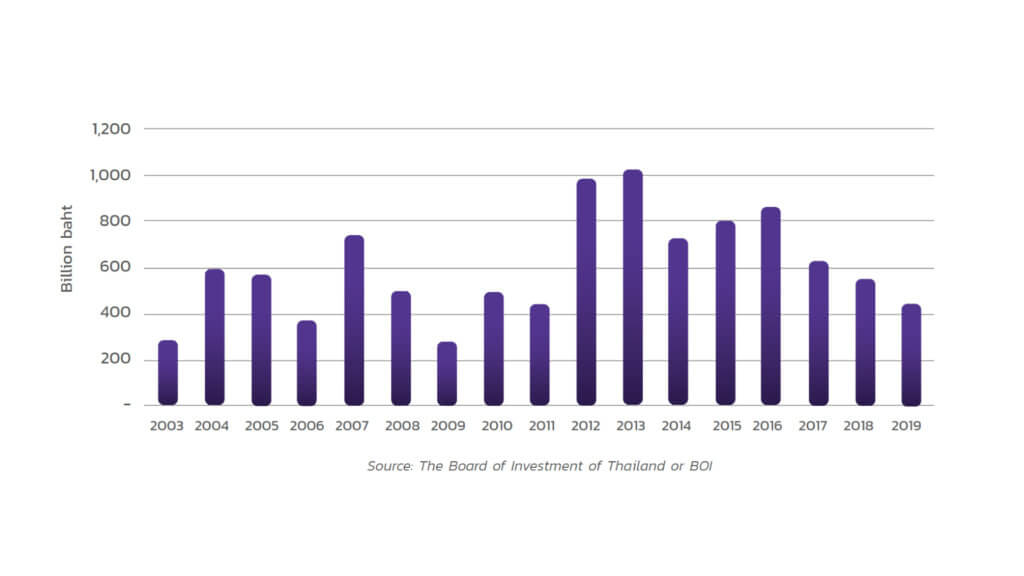

The investment approval by The Board of Investment of Thailand or BOI as of End of 2019

The BOI investment promotion request from the Office of the BOI in 2019 has a higher number of projects than those in the previous year, however, the aggregate approved investment value is lesser. The approved investment promotion of 474.4 billion baht is the lowest figure in the past three years, more than 57% of which is in the eastern area. Although there has been continuous promotion and public relations for investments in the Eastern Economic Corridor Area, the investment in the area is still not as high as it should be. Although

Some investors and foreign entrepreneurs are still waiting for more clarification of the laws and regulations, more investment promotion, a clearer town planning, and more public development in the Eastern Economic Corridor (EEC). The development of various infrastructure, especially high-speed rail and double-track railways in the eastern area which will highly benefit logistics in terms of transportation. The Covid-19 virus crisis affecting the transportation of raw materials or goods from China has a direct impact on the world’s industrial supply chain systems. 2020 will be a difficult year for the industrial sectors, many investors and companies choose to move their production bases out of China and some of them choose to invest in Thailand.

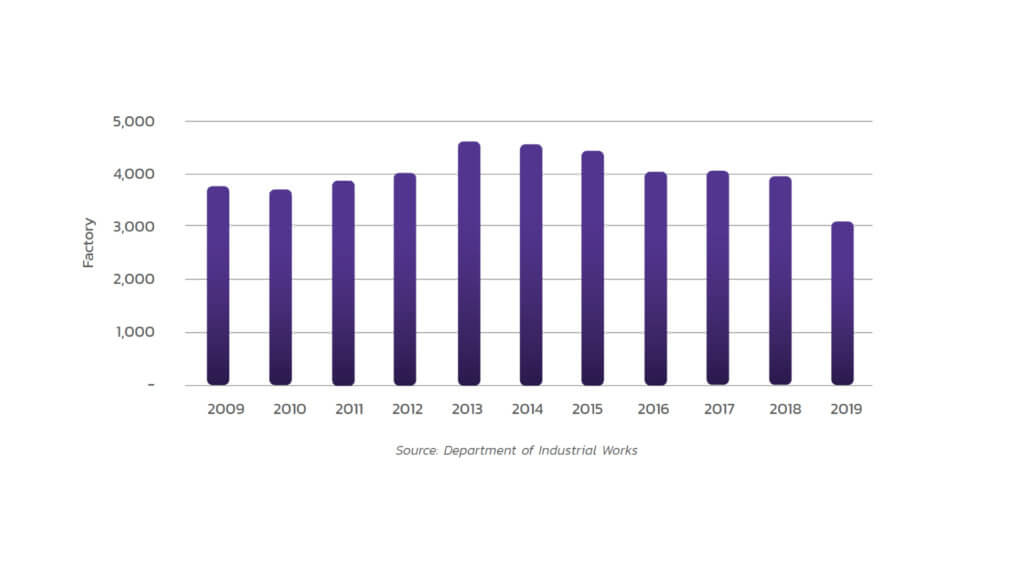

New Factory Licenses in Thailand by Year

The number of newly opened industrial plants or factories have been decreasing continuously in the same direction as investment promotion applications. This is in line with the economic conditions in Thailand and the world economy that has been slowing down over the past 3-4 years. The number of industrial plants and factories that have closed down is also high, because the economic slowdown in Thailand and the appreciation of the baht in the past year has directly affected in export.

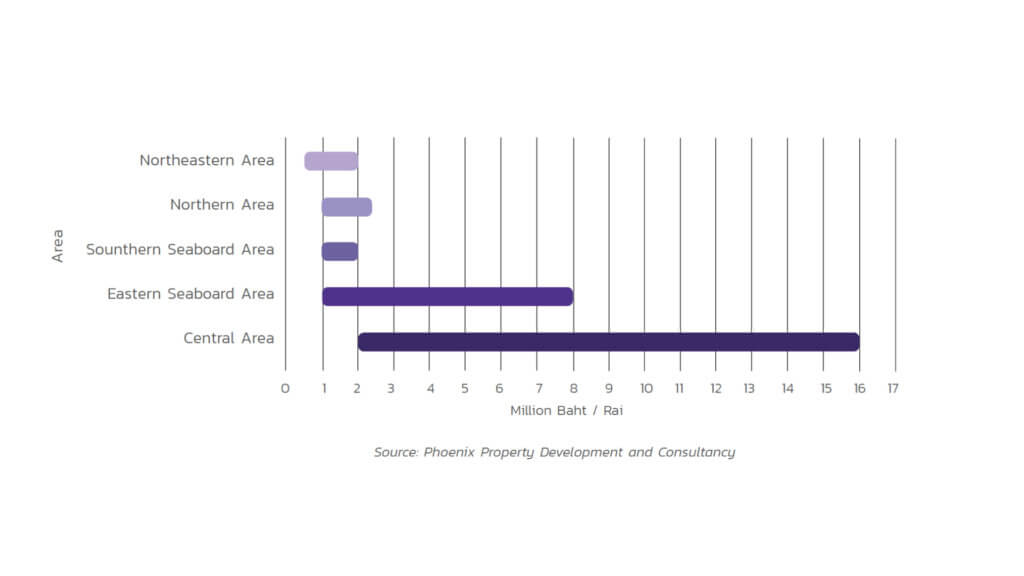

Price

Selling Price of The Land in Industrial Estates in Thailand by Region as of End of 2019

Industrial estates in the central region, especially in Bangkok, have a very high selling price due to low supply and high land price. This has resulted in the industrial estate land price in Bangkok to go up to 16 million baht per rai. While in the central area, the lowest land price in the industrial estate is around 1.5 – 2 million baht per rai.

Industrial estates in the eastern area have the second highest selling price. Although there are many positive factors such as the development of EEC and many infrastructure projects in development. In the future, the offer land price of land in industrial estates will be even higher than the present.

Conclusion

The industrial estate market is in a slowdown according to economic conditions.

Industrial estates in the eastern area will continue to increase for many years.

The demand for land in industrial estates will vary according to the economy of the country and the world economy.

Foreign investors or companies will move their production bases out of China, and some will come to Thailand.

The industry that adopts advanced technology will be the industry that will drive the industrial sector in the future.