“Bangkok Office Market

Still Growing”

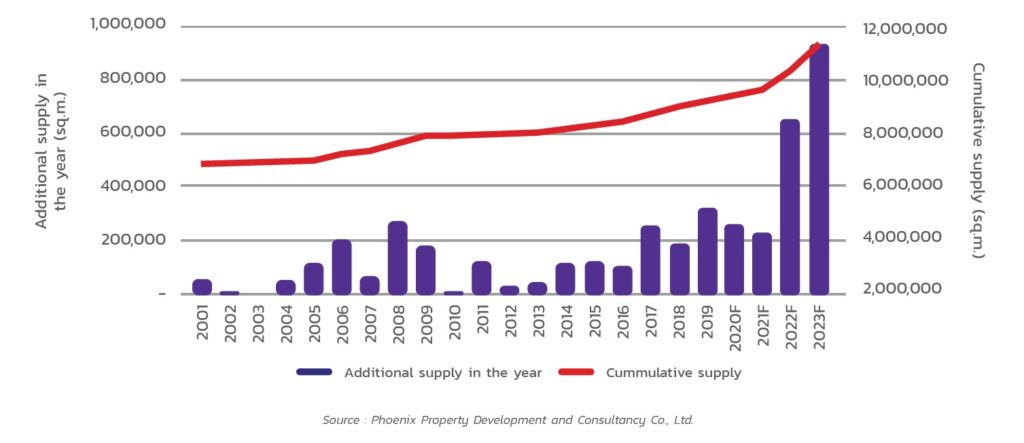

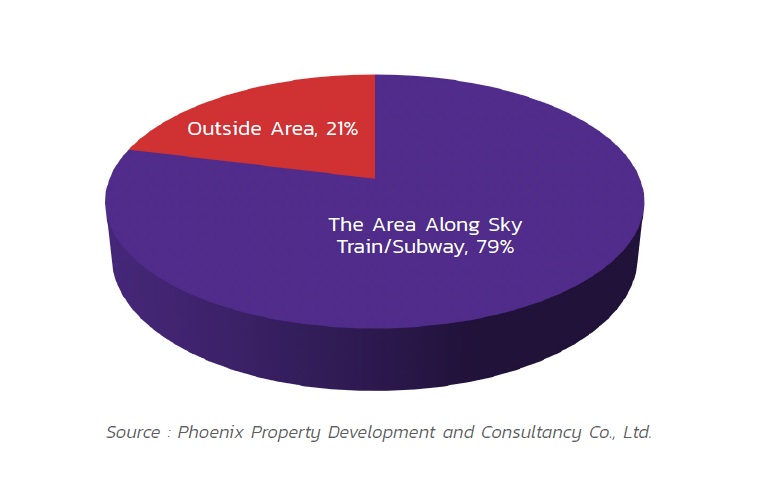

The Bangkok office market is growing continuously in the past few years, especially in the supply side. More than 100,000 sq.m. of new office buildings were completed each year since 2014. There were approximately 300,000 sq.m. of new office spaces added in the market in 2019. Mostly new office buildings are in the area along the sky train and subway lines, although some new office buildings under construction is in the area that far from the mass transit lines. However, the total office space that are far in the area outside mass transit lines is significantly lower than the total office space that are along the mass transit lines or in CBD area.

Supply

Cumulative Office Supply in Bangkok Q4 2019

Office spaces in Bangkok at the end of 2019 was acconted for approximately 9,177,500 sq.m., 312,000 sq.m. of which were completed and opened in 2019. There are more than 100,000 sq.m. of new office areas added in the market each year during 2014 – 2019. Total new office areas rented out per year was around 130,000 – 180,000 sq.m., so average occupancy rate in Bangkok had increased during the past few years.

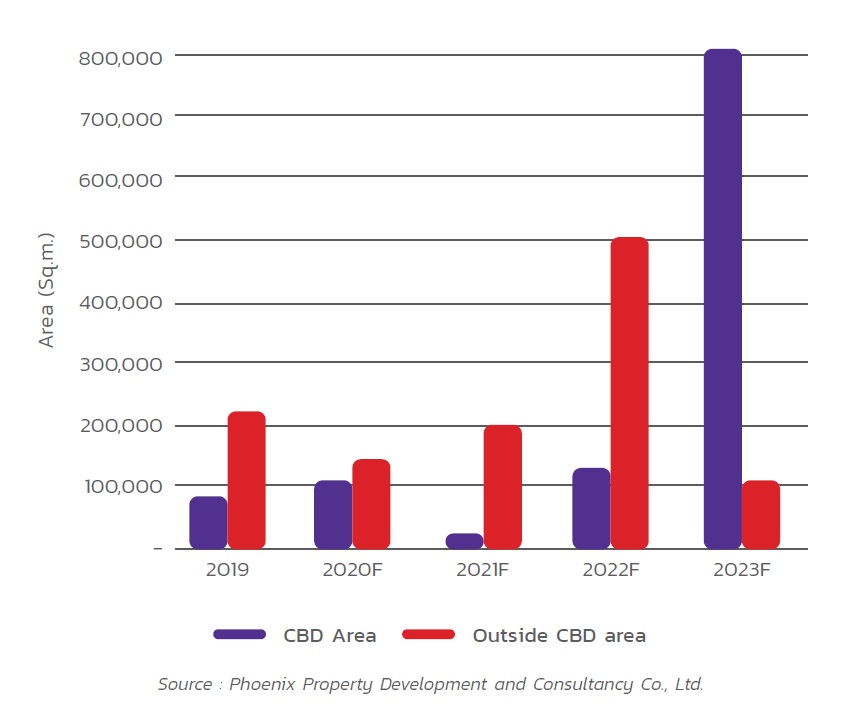

Office supply under construction in Bangkok is accounted for approximately 2 million sq.m., most of which are located in Bangkok CBD Area as a part of mixed-use projects. Total office spaces in mixed-use projects which are scheduled to be completed in 2023 is around 1.46 million sq.m. and mostly are in Bangkok CBD Area.

Proportion of Office Supply in The Area Along Sky train/Subway and Outside Area

Approximately 79% of all office supply in Bangkok is in the area along sky train/Subway line as the first phase of mass transit system is along the main road which is in Bangkok CBD Area. In addition, the official operation of mass transit lines attract new office buildings along the sky train and subway lines. although some office buildings are located outside the sky train and subway lines area. But in the future this proportion will change, because some new office buildings are under construction in the new sky train and subway which are under construction lines. Rental rates of office buildings in the area along sky train and subway lines are dramatically higher than office buildings that are far from the area along sky train and subway lines. This was due to higher land price and the higher potential of the land.

Future Office Supply by Year and Location

Office buildings under construction that are scheduled to be completed in 2020 – 2023 is accounted for approximately 2.07 million sq.m., most of which will be in the area outside CBD Area. However, many mixed-use projects with office spaces that are under construction are expected to be completed in 2023. Therefore, new office supply in CBD area in 2023 will be dramatically higher than those outside the area with total office area of 809,000 sq.m. Both Thai and foreign investors are interested in investing in office building, either as an investment of new project development or as a purchase of existing office buildings in the market for further management.

Many investors and companies are starting to develop office buildings for their own use to generate income in the longer term. Not only are real estate developers interested in investing in office building development, food/beverage, insurance/life insurance, automobile and construction companies are also developing their own office building. New office units that are scheduled to be completed in the next few years will mostly be in general office buildings and in mixed-use projects. A high number of new office supply in the future is in a serious concern as approximately 2 million sq.m. of office unit or 22% of total office building will be completed and launched in the market within 2023.

Demand

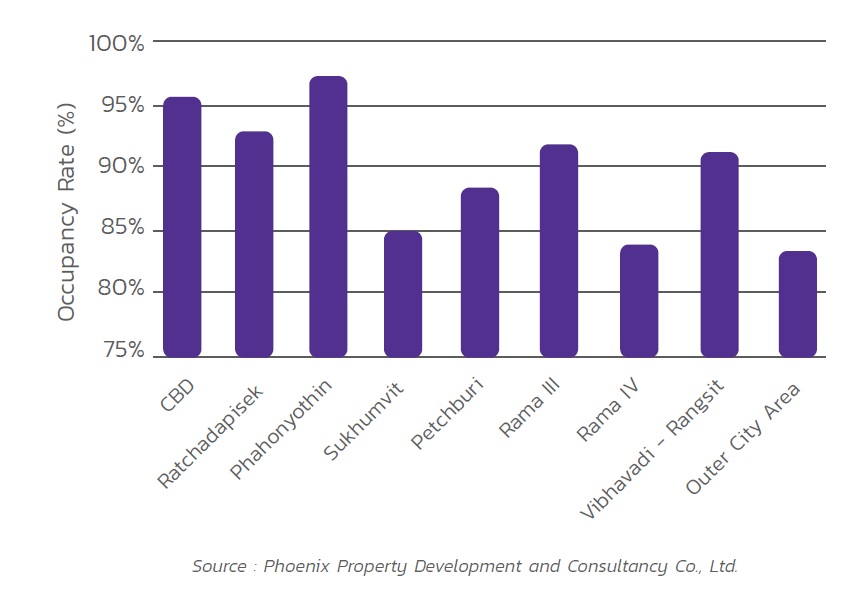

Average Occupancy Rate by Zone

Average occupancy rate of overall office market in Bangkok at the end of 2019 was around 93%, only a few percentage change from past year. Approximately 312,000 sq.m. of new office supply had been added in the market in 2019, while demand for new office space also had not significantly increased from previous year due to the slowdown in global economic and Thailand economic overview has not recovered.

In addition, co-working space business has become a main tenant in some new office buildings. Many foreign and Thai co-working space operators are the majority tenants in office building.

Demand for new office space in 2020 is probably the same as in 2019, due to the fact that many factors still have directly affected in the business and office demand. In addition, some factors from outside of the country and internal factors are probably more serious in 2020.

Modern business format may become the new factor that directly impacts the office market. Lower number of employees is required in the new modern business format as employees are replaced by AI or outsource system. Therefore, demand for office space in the future may be lower and leasable area of one company probably smaller than existing demand. Office market may become one of the businesses that need to be closely monitored in the future.

Rental rate

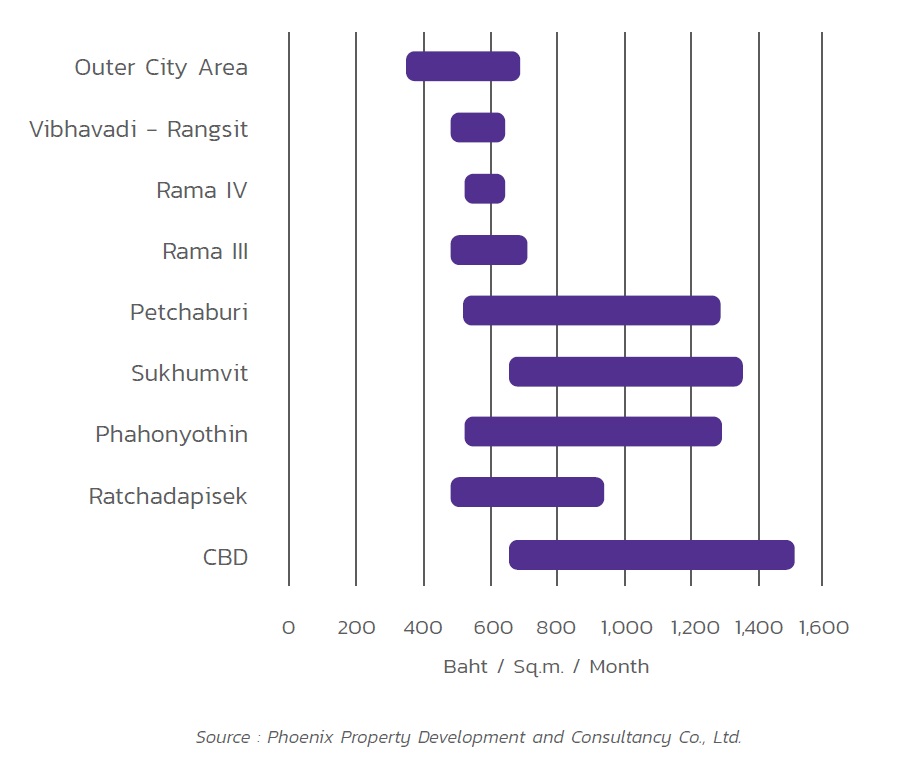

Average Rental Rate by Zone

Average rental rate of grade A office building in Bangkok CBD area has been higher than 1,000 baht per sq.m. per month for many years; however, the increase is insignicant. Grade A office building rental rate in the CBD area have only increased approximately 5% from the previous year. Although the rental rates at various buildings are higher, the asking rate of office buildings that are higher than 1,500 baht per sq.m. per month apply for some areas and some floors only. In addition, achieved rents are usually lower than asking rate depending on each negotiation. Average rental rate of grade B office building in Bangkok CBD area is lower than grade A building in the same location by around 20 – 25%. Rental rate of office building in 2020 is probably similar to those in 2019. Economic situation, slowdown of private investment, and a huge number of future supply in the next few years are important factors that put pressure on rental rate.

Conclusion

Existing of Bangkok CBD area is continued to be a CBD for a long time.

Many zones in the area around Bangkok CBD are more likely to have more office space in the future.

Sky train and subway lines that are extended throughout Bangkok will boost up new office buildings unit.

Rental rate have increased slightly in 2019 and expected to be stable in 2020.